COVID-19 Updates

Our community and local businesses are at the heart of everything we do. Chamber & Economic Development of the Rutland Region is grateful for the health and safety of our business members, community, and your families. As Vermont’s economy slowly reopens and businesses in Rutland County begin working toward this new “normal,” we want to reassure you that CEDRR staff is here for you. We understand there is still a great amount of uncertainty ahead, but we are available as a resource to help you and your employees during this time.

The greater Rutland region is known for coming together in times of need, and the Coronavirus pandemic has been yet another example of times we’ve proudly supported one another.

CEDRR has maintained our strong collaborative focus and is in communication with the other economic development-focused organizations in the greater Rutland Region – including Downtown Rutland Partnership, Rutland Redevelopment Authority, the Rutland Regional Planning Commission, and the Killington Pico Area Association – as well as leaders at the state level and our legislatures. We continue to have discussions and facilitate conversations with local business leaders, and we encourage you to reach out to us to share the impacts that COVID-19 has had on your business or organization.

On May 20, Vermont Governor Phil Scott announced his plans for $400 million in economic relief and recovery. This two-phased approach includes immediate relief to impacted businesses and organizations, as well as long-term recovery efforts. You can view the latest updates on the COVID-19 economic relief and recovery package here. We will continue to share what this package means for you and your businesses in the weeks ahead, as well as more information on how REDC can support your business as you continue planning for the future.

We still have funds available in our COVID-19 Emergency Loan Fund, which can be used to cover expenses and operating costs during this time. We encourage you to reach out to Operations Director Tyler Richardson to determine if this is an appropriate source of funding for your business.

We will continue to share resources as they become available to keep you informed. To receive news and information from CEDRR, please sign up for our newsletter.

In response to the Governor’s newly released executive orders on Friday, Chamber & Economic Development of the Rutland Region (CEDRR) has closed the office to the public and will begin working remotely, Monday, November 16, 2020, until further notice.

The staff at CEDRR remain committed to servicing you, your families, and your businesses through this challenging time. CEDRR staff can be reached by phone or email – contact information for staff can be found here.

We hope that you will continue to shop local, ordering takeout or delivery, and supporting local businesses online or in-store, if possible.

Be well,

Lyle, Tyler, Kim, Penny, and Brooke

Chamber & Economic Development of the Rutland Region Staff

Chamber & Economic Development of the Rutland Region received authorization to offer an Emergency Loan Program through its Revolving Loan Fund to assist businesses that are impacted by COVID-19. USDA Rural Development has authorized CEDRR to use $150,000 from its Revolving Loan Fund for the COVID-19 Emergency Loan Program.

Businesses and organizations can apply for these loans to cover expenses and operating costs during this time. Applications will be reviewed on a rolling basis by CEDRR staff. Recommendations will be made to the CEDRR Finance Committee and reviewed on an as-needed basis for a determination of approval.

4.25% fixed interest rate for a maximum of five years with deferred payments for the first three months

Expedited delivery of funds

Traditional IRP Fees are waived for this program

No penalties for pre-payment for businesses looking to use this funding source as gap financing or until other funds are available

Minimum lending limit is $5,000 and the maximum lending limit is $50,0000

CEDRR encourages prospective applicants to consider how additional debt could impact their businesses and to reach out to us for guidance before beginning the loan process.

For more information on the Emergency Loan Program or the Revolving Loan Fund, contact Operations Director Tyler Richardson at [email protected] or (802) 770-7067

On May 20, Governor Phil Scott announced his proposal for a $400 million COVID-19 economic relief and recovery package, using funds from the $1.25 billion Vermont received from the Federal CARES Act. The proposal, which has two phases, will include $310 million for immediate relief to the most impacted industries and businesses, followed by $90 million for long-term recovery efforts. The Agency of Commerce and Community Development and the Governor are working with the Legislature to pass this historic relief package. ACCD hosted a series of webinars explaining the proposed economic recovery and relief package.

On Friday, June 19, Governor Scott signed into law Act 115, which supported the creation of emergency economic recovery grants for Vermont businesses. Economic recovery grants are now available for businesses across a wide variety of sectors and industries.

Learn more about the COVID-19 economic recovery and relief package →

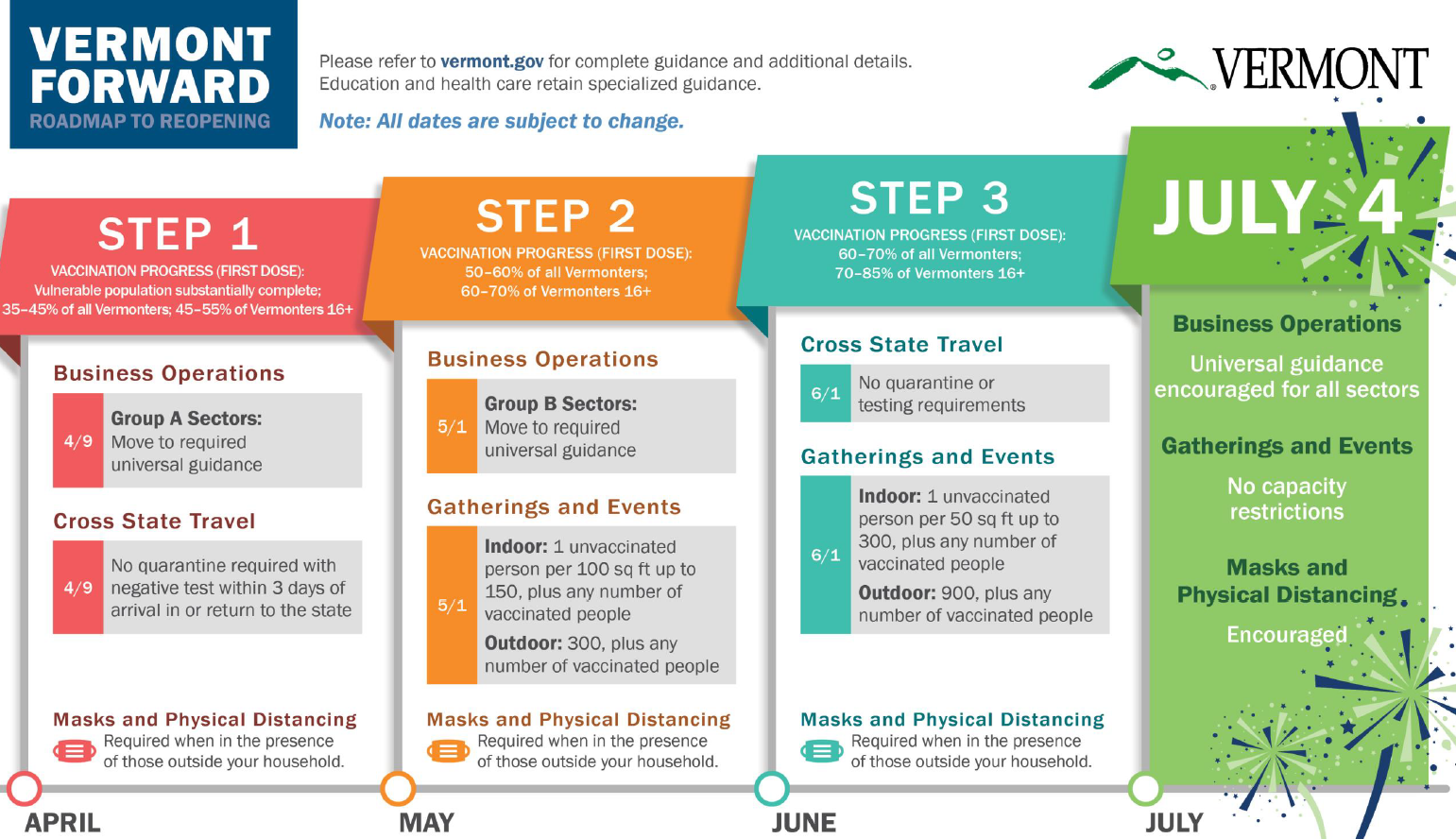

On April 6, 2021, Governor Phil Scott released a reopening guide to help Vermonters and local businesses see the path for a phased return to unrestricted travel, business operations, and event gatherings. The plan was developed by the Department of Health, the Department of Public Safety, and the Agency of Commerce and Community Development and uses vaccination milestones to ensure a safe easing of personal restrictions and continued reopening of the state’s economy. For more information visit the Vermont Forward webpage.

Governor Phil Scott announced mandatory masks in indoor and outdoor public settings where six feet of space between people is not possible, effective August 1, 2020, and with limited exceptions. This requirement will apply to everyone over the age of two years, except when eating, drinking, exercising, or participating in strenuous activity. Additionally, those with medical reasons not to wear a mask will also be exempt; no written documentation will be required in order to preserve the medical privacy of individuals.

Read the executive order strengthening the use of facial coverings →

The Vermont Agency of Commerce and Community Development (ACCD) continues to provide the most up-to-date news and resources for businesses throughout Vermont related to COVID-19.

The Vermont Agency of Commerce and Community Development is supporting Vermont businesses in the following ways:

The Small Business Administration (SBA) has been working diligently to administer disaster relief funding for small businesses throughout the nation. On March 27, 2020, the CARES Act was signed into law to allow additional funding for small businesses.

The CARES Act funding sources included:

On Friday, June 5, the Paycheck Protection Program Flexibility Act was signed into law. These updates make it easier for businesses that have received Paycheck Protection Program loans to qualify for forgiveness. Updates under the Paycheck Protection Program Flexibility Act include an extension of the coverage period to 24 weeks from the origination of the loan (or through Dec. 31, whichever is earlier); reduction of payroll percentage cost from 75 percent to 60 percent; and extension of the repayment period for borrowers who are not eligible for loan forgiveness five years to repay the loan, up from two years. The second draw of PPP Loans is now available.

On February 24, 2021, the SBA established a 14-day exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employees. This will give lenders and community partners more time to work with the smallest businesses to submit their applications, while also ensuring that larger PPP-eligible businesses will still have plenty of time to apply for and receive support before the program expires on March 31, 2021.

SBA also announced four additional changes to open the PPP to more underserved small businesses than ever before. While these changes are being implemented, SBA will work with community partners to improve the emergency relief “digital front door” and conduct extensive stakeholder outreach. And, SBA will strengthen its relationships with lender partners to advance equity goals, deliver funding efficiently, and prevent fraud, waste, and abuse. SBA will:

In early October, SBA announced simpler PPP forgiveness for $50,000 loans or less. This action streamlines the PPP forgiveness process to provide financial and administrative relief to America’s smallest businesses while also ensuring sound stewardship of taxpayer dollars.

Businesses are highly encouraged to contact the Small Business Administration’s Vermont District Office directly for questions and seek professional guidance before considering taking on additional debt during this time.

The American Rescue Plan Act established the Restaurant Revitalization Fund (RRF) to provide funding to help restaurants and other eligible businesses keep their doors open. This program will provide restaurants with funding equal to their pandemic-related revenue loss up to $10 million per business and no more than $5 million per physical location. Recipients are not required to repay the funding as long as funds are used for eligible uses no later than March 11, 2023.

To contact SBA Disaster Assistance Customer Service call 1-800-659-2955 or email [email protected]. The local SBA office can also be reached at 802-828-4422.

Professional guidance can be found from business advisors with the Vermont Small Business Development Center. Contact Rutland County Business Advisor Nancy Shuttleworth.

The Vermont Manufacturing Extension Center has launched Manufacturing Exchange, a resource for Vermont manufacturers to share their needs to help further identify regional assets that can then supply these needs. This tool serves as a live feed for businesses to start conversations, reply to others, and form workgroups to close the gap of regional needs. As one of the partners for this initiative, REDC is encouraging all regional manufactures to join this effort. To join and register your business, contact Kim Rupe.

The Center for Disease Control and Prevention will be providing frequent updates of COVID-19 and has developed recommended guidelines for businesses to remain safe and healthy.

The Vermont Department of Labor is increasing its resources and expedited its process for unemployment. In addition, they continue to provide updated information for business owners and employees.

The Vermont Department of Financial Regulations has developed resources regarding insurance-related questions and other business impact resources.

The Vermont Small Business Development Center continues to advise small businesses throughout the state. Also, find Disaster Recovery Resources developed by VtSBDC during Tropical Storm Irene.

SCORE Vermont is an all-volunteer run organization that provides guidance for individuals looking to start or grow their business. In response to COVID-19, individuals are able to request a business mentor to navigate state and federal resources.

The Vermont Department of Health is providing safety measures for businesses, communities, and individuals. Specifically, guidance for businesses as they navigate the changes of COVID-19.

Center for Women & Enterprise has developed funding and resource opportunities for small businesses throughout New England. Resources include funding opportunities, virtual workshops, and more.

Vermont Economic Development Authority continues to closely monitor the developments of businesses impacted by COVID-19. VEDA remains available to answer questions during this time while they continue to develop new resources and opportunities for small businesses impacted.

The Vermont Chamber of Commerce is asking businesses and individuals to submit their ideas for helping businesses through COVID-19 and during financial recovery. The ideas collected through the Economic Recovery Solutions Hub will be shared with the State of Vermont Economic Mitigation and Recovery Task Force, as well as other state leaders.

Love Vermont is a directory of Vermont businesses affected by closing as a result of COVID-19 who are now selling gift certificates online, offering take-out or delivery, online shopping, discounts, or asking for donations support their business.

The Vermont Landlord Association offers a free, online mediation program for landlords and tenants to work through and solve disagreements. Those participating will have access to a professional mediator to help guide the online session.

The Vermont Chamber of Commerce has partnered with Vermont Independent Restaurants to conduct a survey regarding the impacts of COVID-19 on the restaurant industry. The data collected will be used for continued restaurant relief and recovery advocacy work.

The IRS reviewed its collection activities to see how it could provide relief for taxpayers who owe taxes but are struggling financially because of the pandemic. The agency is expanding taxpayer options for making payments and other ways to resolve tax debt.

Taxpayers who owe taxes always had options to get help through payment plans and other tools from the IRS. The new IRS Taxpayer Relief Initiative is expanding on those tools.

The USDA Coronavirus Food Assistance Program 2 provides financial assistance to agricultural producers who continue to face market disruptions and associated costs due to COVID-19. The deadline to apply for these funds is December 10th. Find full details at the USDA program website.

The USDA Rural Development office is able to assist rural small businesses and agricultural producers by conducting and promoting energy audits and providing Renewable Energy Development Assistance (REDA). Learn more about the program and how to apply.

Below are links to recent updates regarding possible business owners in the state of Vermont.

The Vermont League of Cities and Towns, the Vermont Agency of Commerce and Community Development, and the Secretary of State’s office has been working to compile resources and tools for Vermont’s municipalities.

Individuals and families continue to navigate the current changes around them in ensuring they are financially secure for the weeks ahead. Below are links to reputable updates and news articles around resources for employers to provide their employees during this time.

Page Updated: 4/23/2021